A brief history

Kava was co-founded by Brian Kerr, Ruaridh O’Donnell and Scott Stuart in 2018. Kava, which is built on the Cosmos network, is a DeFi lending platform that allows users to borrow and lend multiple cryptocurrencies without the involvement of intermediaries. What makes Kava unique is its cross-chain operation and interoperability that is facilitated through the Cosmos network feature known as “zones.” Zones allow users of the Kava lending protocol to deposit a wide array of non-native cryptocurrencies such as Binance Coin (BNB), Bitcoin (BTC), Ethereum (ETH), and other major cryptocurrencies as long as they are first wrapped as BEP-2 Binance Chain standard assets.

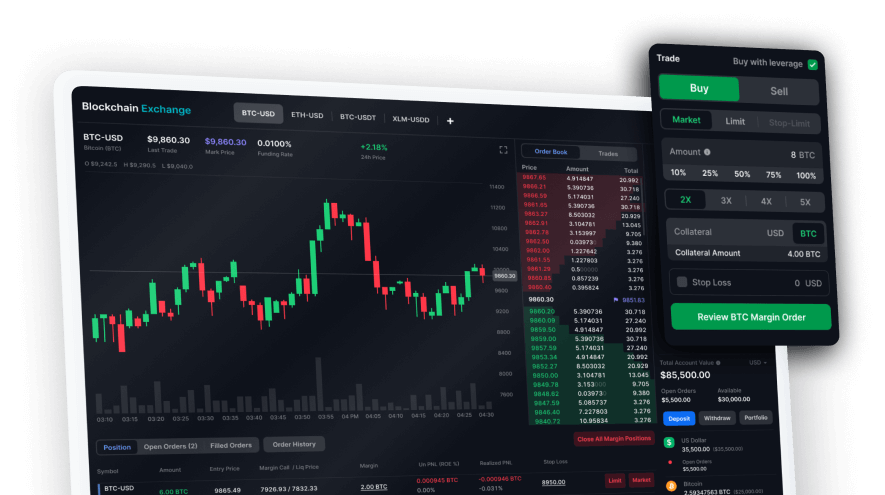

KAVA in practice

Kava utilizes a dual token strategy to ensure that each user gains the maximum flexibility and usability possible. The two coins that are used in the Kava ecosystem are USDX and KAVA. KAVA is the utility token of the platform. KAVA acts as a governance token and allows users to vote on critical parameters which guide the network’s upgrades. Additionally, KAVA can be used for staking on the network and other platforms, like Ethereum, thanks to the interoperability achieved through the Cosmos network. Users can earn an APY based on their stakes, while validators are incentivized to secure the network and verify network operations. USDX is the stablecoin for the Kava network and it is what you receive and pay back your loans in. Users lock their funds in smart contracts, which then results in minting new USDX tokens that users can take as a loan based on collateral. An automated process on the platform then locks up the value of USDX to match the value of the US dollar which neutralizes the volatility- this is called the collateralized debt position. To close the CDP and retrieve the collateralized crypto, users need to cover their debt and pay a lending fee. When the initial collateral is redeposited the USDX is burned. By collateralizing cryptocurrencies to mint USDX, users also receive weekly rewards in the form of KAVA.