A brief history

Co-founded and managed by Antoni Trenchev, Nexo was launched in 2017 and describes itself as the world’s leading regulated financial institution for digital assets aiming to harness the power of blockchain technology to successfully solve inefficiencies in the lending markets. Nexo aims to provide digital asset holders with the best of both worlds - instant access to cash and high-yielding interest on idle assets without compromising security, as the network runs military-grade security with 256-bit encryption and 375,000,000 USD insurance. NEXO was initially distributed in February of 2018 through an airdrop. In March 2018 Nexo held an ICO pre-sale, and in April 2018 an ICO token sale. During this time a hard cap of 525,000,000 NEXO was distributed, raising approximately $52,500,000 in Bitcoin (BTC) and Ethereum (ETH).

NEXO in practice

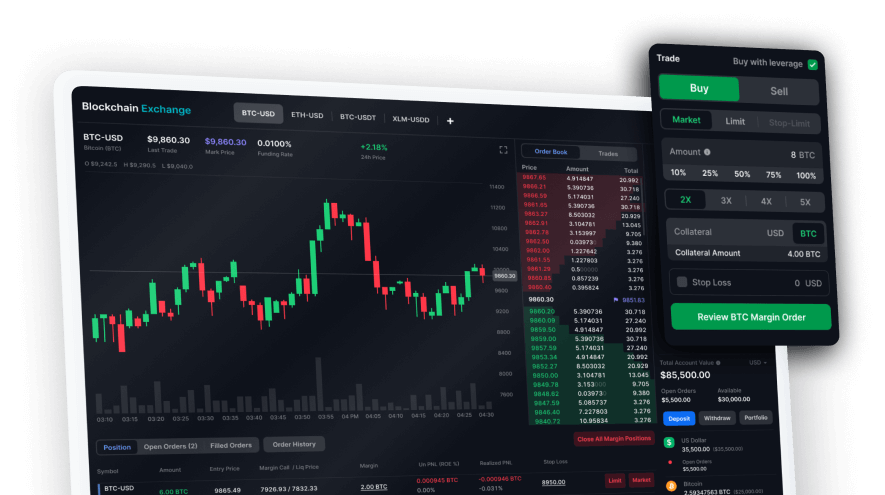

Nexo allows customers to earn interest on crypto deposits and also take out loans. For users who choose to earn interest on their deposits, interest can be earned in crypto coins or stablecoins. Crypto pays up to 8% while stablecoins pay up to 12%. Interest is compounded daily which means you get an interest payout every day, and money can be added and withdrawn at any time. Additionally, there aren’t any lockup periods on deposits. Nexo also allows users to borrow in cash or stablecoins without a credit check. Borrowing rates start at 5.9% and do not require users to sell their crypto assets. Instead, the borrowed amount is called a credit line, which can range from $50 to $2 million. The amount that a user is allowed to borrow is dependent on the amount of crypto that the user has deposited. Using Bitcoin as an example, your credit line will be 50% of the BTC on deposit but will fluctuate based on BTC’s market value. For other cryptos, the amount might be more or less than 50%. If the value of your crypto asset begins dropping, you’ll receive a notification from Nexo to deposit more crypto to maintain your collateral. If you don’t deposit more crypto, funds will move from your savings wallet to your collateral account, and if there isn’t anything in your savings wallet, Nexo will begin selling off your collateral to repay the loan. Additionally, using NEXO to repay loans results in a lower interest rate.