A brief history

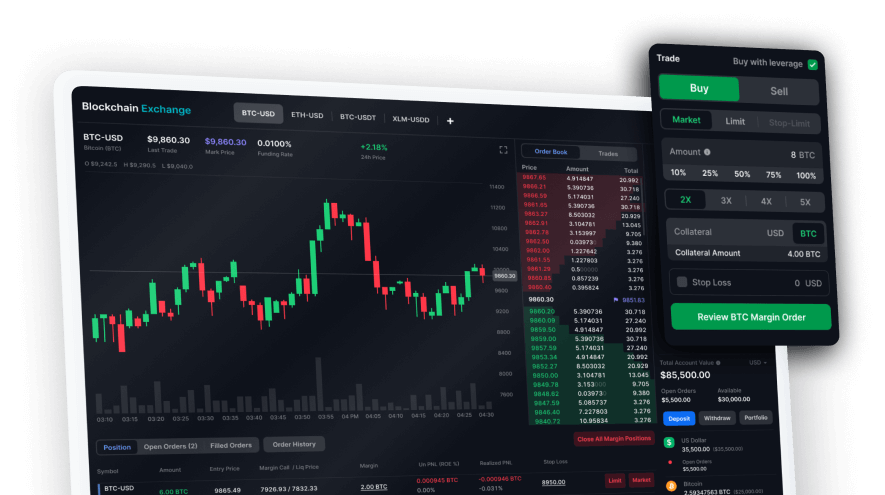

FTX was founded in 2018 by MIT graduate and former Jane Street Capital international exchange-traded funds trader Sam Bankman-Fried. FTX's wide range of products and easy-to-use desktop and mobile trading apps draw crypto investors of all skill levels, from beginners to seasoned professionals. FTX's key products include futures, leveraged tokens, options, MOVE, and spot markets. Instead of more traditional margin trading, which traders can use to multiply their gains or losses, FTX uses leveraged tokens. FTX’s leverage tokens free users from micromanaging their collateral or risk. Basically, they are ERC20 tokens that have leveraged exposure to crypto. There are 3x and 10x long positions as well as 1x, 3x and 10x short positions. FTX’s BULL and BEAR leverage tokens automatically manage their exposure, rebalancing to maintain their target leverage and prevent liquidations. As ERC20 tokens, users can withdraw them from the platform and trade them. With Futures, traders can take both long and short bets on leading cryptocurrencies using over 100 quarterly and perpetual futures pairs. Additionally, FTX uses a centralized collateral pool & Universal stablecoin settlement, which means that all FTX derivatives are stablecoin-settled and require only one universal margin wallet.

FTT in practice

FTT is the backbone of the FTX ecosystem. The team at FTX has carefully designed incentive schemes to increase network effects and demand for FTT, while also decreasing its circulating supply. One-third of all fees generated on FTX are used for an FTT repurchase until at least half of all FTT is burned. FTT can also be used as collateral for futures positions. This increases utility and demand for FTT. Customers who hold a certain amount of FTT for a period of time will also receive lower FTX futures fees.